How to Sell IoT — 6 Best Practices

How to Sell IoT — 6 Best Practices

- Last Updated: December 2, 2024

Benson Chan

- Last Updated: December 2, 2024

The Decentralization Problem

In a corporate environment, the buyer of Information Technology (IT) solutions and services is well established and known. But when it comes to IoT solutions, it’s much less clear who’s actually buying, and thus how to sell IoT.

These new class of solutions falls into a “no man’s land” between IT, the business units, operations and services groups. Unlike the centralized IT procurement model, sourcing of IoT solutions is largely decentralized with the buyers residing in one of several internal organizations.

That’s because IoT is often valuable to many parts of an organization.

If you provide a remote sensing and monitoring solution to, say, an industrial grade washing machine manufacturer, the data collected would be valuable to the after-sales unit, the product design unit, and the sales and marketing units.

The after-sales unit would use the data to determine when service is required and to spot early signs of trouble. The product design unit would use the data to improve the next model. And the sales and marketing units would use the data to understand which features customers use the most, allowing them to develop more effective messaging.

So who’s actually buying the IoT solution?

The vast majority of companies don’t have a centralized organization, such as an IoT office, which makes the buying decisions for these solutions.

The buyer may be the traditional IT organization with one manufacturer, the product design group with another, and the after-sales services organization with yet another manufacturer. This lack of a centralized buying organization makes it difficult for solution vendors to find the “right” buyer and slows down the sales process.

IT and IoT Address Different Organizational Domains

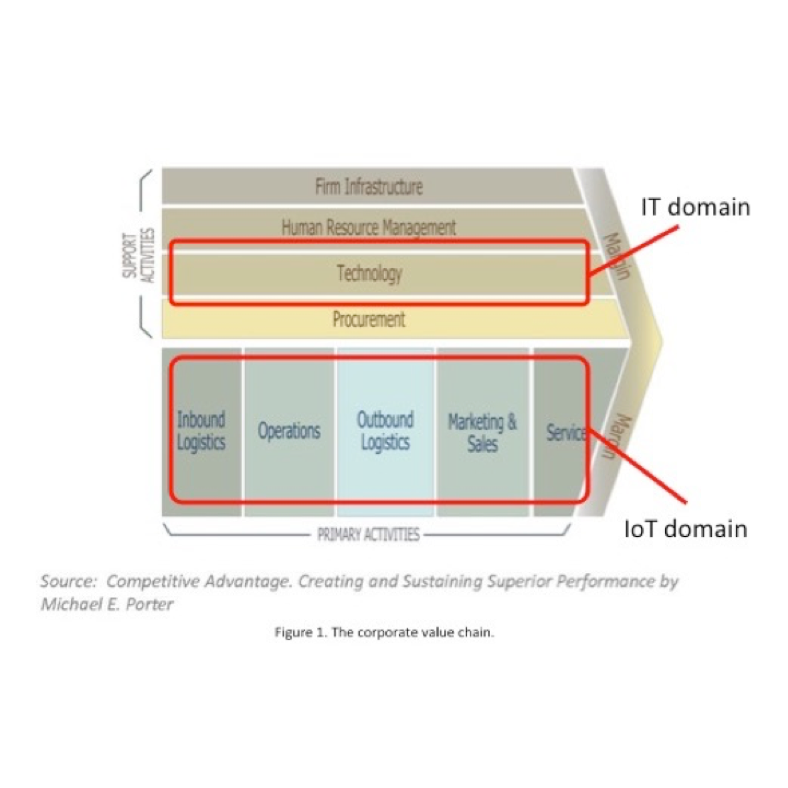

In order to understand why IoT purchasing is decentralized, consider the value chain of a business (Figure 1). A corporation, small or large, performs a series of activities that create value (e.g. produce a product or service that customers buy) for its customers.

Primary activities are those functions that are directly involved in the creation and delivery of a product or service. These functions include sourcing the raw materials, transforming them into a finished product or service, distribution of those goods, selling and marketing, and support of these goods post-sales.

Support activities aren’t directly involved in the primary value generation activities, but support the organizations and functions that do. These include IT, finance, human resources, legal, and procurement.

Image Credit: Strategy of Things

IoT solutions are directly involved with primary activities.

In the remote sensing solution example from above, the manufacturer’s after-sales team uses the data to detect early signs of trouble. It then proactively orders replacement parts and schedules an on-site service call with the customer to fix the problem before the washing machine breaks down.

This step of predictive and proactive maintenance directly creates value for the customer. In contrast, IT may maintain the database that stores the customer data, or build the integration that allows the data to connect with the spare parts order management system and service appointment booking system.

Despite the networked nature of IoT solutions, IoT is not IT.

IoT is more like industrial technology, or operations technology than information technology. It’s for this reason that IoT occupies a different domain than IT and why the IoT buying process is decentralized.

IoT and IT Must Collaborate and Coordinate

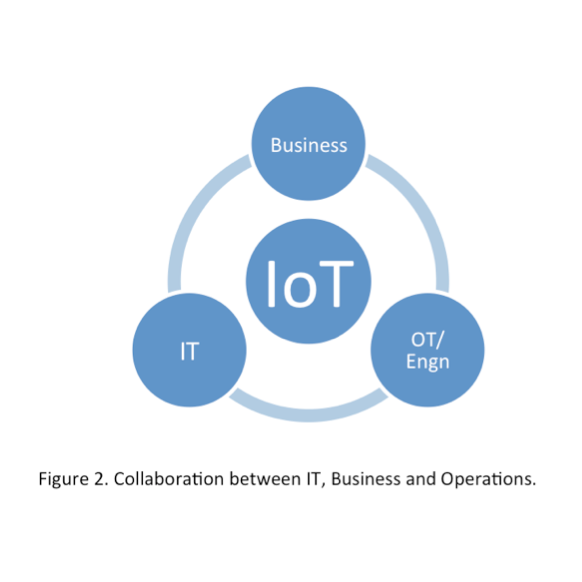

In today’s corporations, IoT is a collaborative effort by three different organizations — IT, the business units, and the primary value creation functions such as operations, manufacturing, marketing, and engineering (Figure 2). The primary buyer will come from one of these organizations.

Image Credit: Strategy of Things

In order for a purchase to actually happen, these organizations must coordinate among themselves over roles and responsibilities, budget allocation and transfer, and resource allocations. Some of these negotiations and planning may occur in a structured forum, such as in a monthly business unit-IT coordination council or steering committee.

Because IoT management and procurement is decentralized in most of today’s corporations, this collaborative buying process is commonplace. While this adds complexity and slows down the adoption process, it also exposes the value of IoT to a larger audience, drives interest across the corporation, and facilitates future buying efforts.

How to Sell IoT — 6 Best Practices for IoT Vendors

1. Understand where your solution fit within the corporate value chain.

Whether you’re selling an on-premise or a SaaS-based IoT solution, determine where IT and IoT fit within the context of your specific IoT solution. This will help you understand who the primary buyers are, as well as the secondary buyers, and the role of IT and the various business functions.

2. Engage the corporate Digital, Transformation, and Innovation offices.

In a decentralized procurement environment for IoT solutions, these offices (if they exist) have visibility and influence into a lot of cross-functional innovation initiatives (often involving the same functional groups affected by your IoT solution). They will save you a lot of time and point you in the right direction.

3. Engage with every function touched by your solution.

Each of these organizations is a potential buyer (primary and secondary) of your solution. In a decentralized buying environment, they must collaborate with each other to pool their budgets and resources. You need to ensure that all these organizations understand and support your solution.

4. Connect the dots for your buyers.

Your solution sits in-between IT, the business units and the various operations functions. Your buyer won’t have the support and resources to deploy your solution. Help your buyer plan for the internal collaboration meetings. Identify what resources, support, and budget is required from other teams. Provide interfaces, sample agreements, a list of the roles and deliverables, as appropriate.

5. Build your sales pursuit plan around a decentralized procurement process.

This is a more complex sales engagement and requires interactions with multiple organizations. Build and plan your resources and support around a longer sales cycle.

6. Help your buyer understand how to buy from you if you’re a startup.

Using traditional corporate procurement processes when buying IoT solutions from startups isn’t effective, and will only increase the buyer’s risks. Help your prospects develop a new set of procurement practices when buying solutions from startups.

The Most Comprehensive IoT Newsletter for Enterprises

Showcasing the highest-quality content, resources, news, and insights from the world of the Internet of Things. Subscribe to remain informed and up-to-date.

New Podcast Episode

Moving Past the Pilot Phase in IoT and AI

Related Articles

Are We Running Out of Infrastructure Capacity? What IoT Leaders Need to Know

December 18, 2025

Clarity Wins: What the Blue Jays’ World Series Run Teaches Tech Leaders About Alignment and Execution

October 24, 2025

The 7 Worst Examples of IoT Hacking and Vulnerabilities in Recorded History

October 3, 2025